Is $500 USD a Lot in India? Real Cost Breakdown & Buying Power

Oct, 8 2025

Oct, 8 2025

USD to INR Converter & Budget Planner

Converted Amount:

Estimated Budget Usage:

Tips to Stretch Your Money:

- Use public transport like buses and metros instead of taxis.

- Opt for street food which is affordable and delicious.

- Book hostels with flexible cancellation policies.

- Cash is preferred for small vendors and street stalls.

- Exchange money at banks or certified Forex bureaus.

When you hear 500 US Dollars a sum of five hundred United States dollars, often used as a benchmark for short‑term travel budgets, the first question is how many Indian rupees that actually becomes. The answer isn’t just a number - it’s a mix of exchange rates, local wages, and the price of everyday items.

Quick Takeaways

- At today’s rate (≈₹83 per $1), $500 equals roughly ₹41,500.

- Average monthly salary in urban India is about ₹30,000‑₹40,000, so $500 covers a full month’s earnings for many workers.

- It can fund a comfortable two‑week stay in mid‑range hotels, daily meals, and local travel in most cities.

- Large expenses like air tickets, high‑end shopping, or long‑term rent will quickly eat the budget.

- Stretching the money further means using public transport, street food, and budget accommodations.

Understanding the Exchange Rate

The USD to INR exchange rate the market price at which US dollars are swapped for Indian rupees fluctuates daily. As of October2025, one US dollar buys about 83 Indian rupees. Multiply that by 500, and you get roughly ₹41,500. This raw conversion tells you the buying power in nominal terms, but it doesn’t capture local price differences.

Purchasing Power in India

Purchasing Power Parity (PPP) an economic metric that adjusts for price level differences between countries shows that a dollar stretches farther in India than in the United States. According to the World Bank’s 2024 PPP data, the cost of living in India is about 30% of that in the US. In practical terms, what costs $1 in the US often costs just ₹20‑₹30 in India.

How 0 Stacks Up Against Common Expenses

| Expense | Average Cost (INR) | Share of $500 (₹41,500) |

|---|---|---|

| Mid‑range hotel (per night) | ₹2,500‑₹4,000 | 6‑10% |

| Street food meal | ₹80‑₹150 | 0.2‑0.4% |

| Monthly metro pass (Delhi/Mumbai) | ₹1,000‑₹1,500 | 2‑3.5% |

| Domestic flight (economy) | ₹5,000‑₹9,000 | 12‑22% |

| Average monthly salary (urban) | ₹30,000‑₹40,000 | 72‑96% |

| Gym membership (mid‑range) | ₹1,200‑₹2,000 | 3‑5% |

When $500 Is Enough

If you’re planning a two‑week backpacking trip across North India, $500 can comfortably cover:

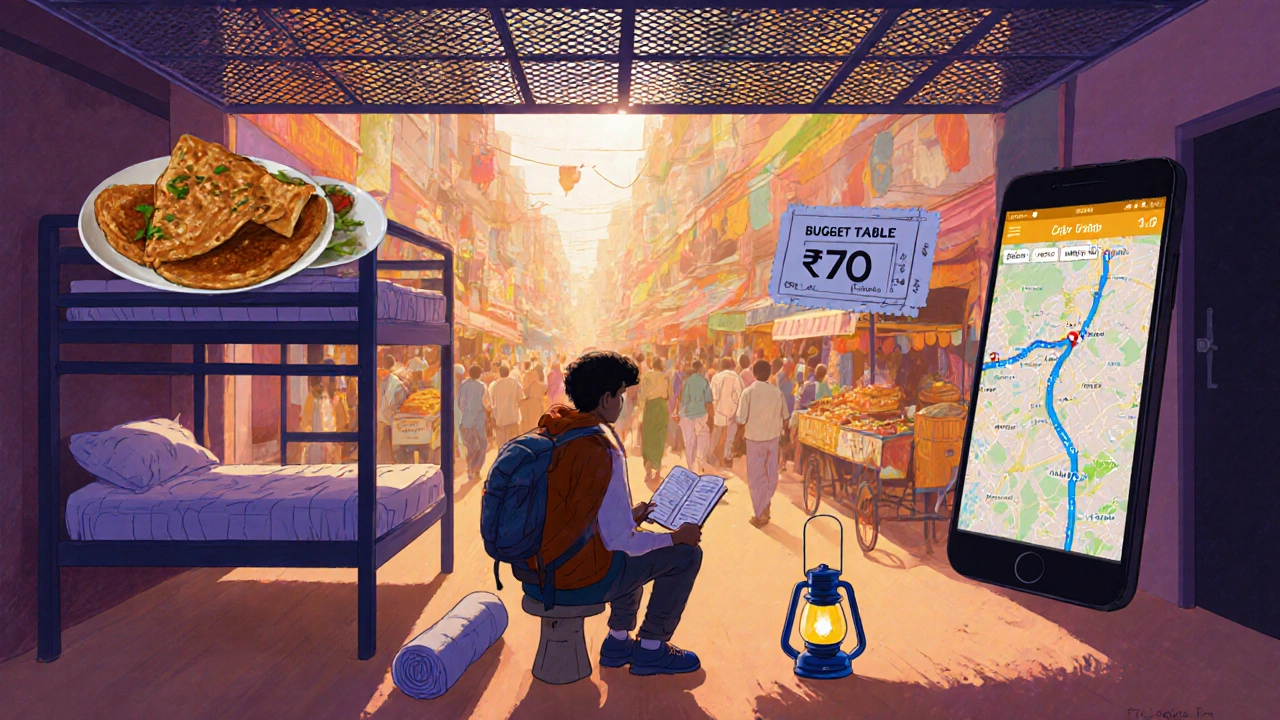

- Hostel dorm beds at ₹500‑₹800 per night.

- Eat at local dhabas and street stalls, spending ₹150‑₹250 per meal.

- Travel between cities by train or bus, costing ₹500‑₹1,200 per leg.

- Entry fees to major attractions (e.g., Taj Mahal, Jaipur forts) that typically range ₹200‑₹500.

In this scenario, you’re essentially living on the equivalent of a modest Indian salary, which aligns with the PPP insight that $500 matches a month’s earnings for many workers.

When It Falls Short

For bigger-ticket items, $500 quickly loses its punch. Consider these examples:

- A round‑trip international flight from NewYork to Delhi often exceeds $800 (≈₹66,000).

- Renting a one‑bedroom apartment in central Mumbai can cost ₹45,000‑₹70,000 per month.

- High‑end electronics (e.g., a mid‑range smartphone) run around ₹30,000‑₹40,000, leaving little for daily expenses.

In such cases, $500 acts more like a supplemental fund rather than a primary budget.

Tips to Stretch Your Dollars

Here are a few practical moves that let you get more bang for your buck:

- Use public transport buses, metros, and trains that run at subsidised rates instead of taxis. A metro ride in Delhi is under ₹30.

- Opt for street food affordable, authentic dishes sold by local vendors. A plate of masala dosa costs around ₹70.

- Book accommodation on platforms that offer “pay‑at‑hostel” or “free cancellation” deals; you often find beds for ₹400‑₹600.

- Carry cash for small purchases; many small shops don’t accept cards and may add a surcharge.

- Exchange money at reputable banks or certified Forex bureaus to avoid the 5‑10% spread you get at airport kiosks.

Real‑World Example: Two‑Week Delhi‑Agra‑Jaipur Loop

Let’s break down a sample itinerary:

- Accommodation: 14 nights in budget hostels @ ₹600 each = ₹8,400.

- Food: 3 meals/day @ ₹200 avg = ₹8,400.

- Transport: Train Delhi‑Agra @ ₹500, Agra‑Jaipur @ ₹600, Jaipur‑Delhi @ ₹800 = ₹1,900.

- Attractions: Taj Mahal entry ₹1,300, Amber Fort ₹500, museums ₹300 = ₹2,100.

- Miscellaneous (SIM card, laundry, souvenirs) = ₹2,000.

Total ≈ ₹22,800, leaving nearly ₹18,700 of your $500 budget for comfort upgrades or extra days. This illustrates how $500 can comfortably fund a classic Golden Triangle tour if you stick to mid‑range choices.

Conclusion: Is $500 a Lot?

In Indian terms, USD 500 in India is a sizable amount for short trips and covers the average monthly earnings of many city dwellers. It’s enough for a decent two‑week travel plan, but it won’t fund long‑term stays, high‑end shopping, or expensive flights. Knowing the exchange rate, PPP, and typical cost categories lets you gauge whether $500 feels “a lot” for your specific plans.

Frequently Asked Questions

How many Indian rupees do I get for $500 today?

At an exchange rate of about ₹83 per US dollar, $500 converts to roughly ₹41,500. Rates vary, so check a reliable Forex source before you exchange.

Can $500 cover a month’s rent in India?

In many tier‑2 cities, a modest one‑bedroom apartment costs ₹12,000‑₹18,000 per month, so $500 (≈₹41,500) would comfortably cover rent plus utilities. In metros like Mumbai or Delhi, rent often exceeds ₹40,000, so $500 may fall short.

Is it better to use credit cards or cash for daily expenses?

Cash is king for small vendors and street food, where cards may be refused or attract extra fees. For hotels and larger merchants, cards are safe and often give you better exchange rates.

What’s the best way to avoid exchange‑rate losses?

Withdraw cash from ATMs linked to major banks, use a no‑foreign‑transaction‑fee credit card for big purchases, and compare rates at banks versus airport kiosks. Avoid street exchangers who often inflate rates.

How does the cost of living in Delhi compare to Mumbai?

Both are expensive metros, but Mumbai’s housing market is typically 10‑20% higher than Delhi’s. Food and transport costs are comparable, though Mumbai’s coastal location can push seafood prices up.